Ohio’s real estate market is full of opportunity right now. Median home prices sit around $247,000—well below what you’d pay in most parts of the country—and rental rates have climbed 16% in the past year. These conditions create opportunities worth examining closely.

However, many investors encounter a common obstacle: traditional financing requirements. Conventional lenders typically require W-2s, two years of tax returns, and extensive personal income documentation to qualify borrowers.

If you’re self-employed, managing your taxes strategically, or just prefer keeping your personal finances separate from your investments, this creates real headaches. What shows up on paper rarely tells the full story of your financial position.

That’s exactly why we built our DSCR (Debt Service Coverage Ratio) Investor Cash Flow loan program.

With a DSCR loan, you qualify based on what matters: the property’s rental income, not your employment history, or your tax returns, or W-2s. We only care about the property’s income, and its ability to stand on its own and cover what it owes.

What Are DSCR Loans?

DSCR stands for Debt Service Coverage Ratio, a metric we use to determine whether a property generates enough rental income to cover its mortgage payment.

The formula is simple:

DSCR = Monthly Rental Income ÷ Monthly Debt Obligations (PITIA: Principal, Interest, Taxes, Insurance, and HOA)

A DSCR of 1.00 means the property’s rental income covers the mortgage payment exactly—you’re breaking even on cash flow. Anything above 1.00 means the property is generating more income than needed to service the debt.

For example, if a property generates $1,500 per month in rent and the total monthly debt obligation is $1,000, the DSCR is 1.5. This means the property generates 50% more income than needed to cover the mortgage, making it a candidate for our DSCR financing.

Why Investors in Ohio Are Turning to Our DSCR Loans

Picture this: you’ve got half a million in liquid assets and a growing portfolio. But traditional lenders only look at your tax returns. You’ve been smart with write-offs, so your reported income looks low on paper. Suddenly, you’re “too risky” to lend to.

It doesn’t make sense. Your actual financial strength is solid, but conventional underwriting can’t see past the 1040.

That disconnect is frustrating, and it’s just one reason investors are turning to our DSCR program. Here are a few more:

Portfolio Scaling Opportunities

With LendSure, you can close multiple DSCR loans simultaneously. Finance unlimited properties—up to 10 loans per investor. No waiting in line. No arbitrary caps because some underwriter decided you’ve “done enough.”

Whether you’re targeting high-growth Columbus or value plays in Cleveland, you can move across Ohio’s markets without starting from scratch every time.

Strong Rental Demand

Average rents in Ohio have reached approximately $1,350 in 2025, with select markets experiencing growth rates between 2-8% year-over-year.

Metro areas like Columbus, Cincinnati, and Cleveland are driving much of this growth, while smaller markets like Toledo, Akron, and Dayton are also experiencing tightening vacancy rates.

This strong rental demand coupled with our DSCR loan qualification allows investors to build real estate portfolio around an existing, untapped stream of income

Ohio Has Affordable Entry Points

Ohio’s median home price of $247,000 is significantly lower than the national average, and cities like Toledo ($135,000), Cleveland ($135,000), and even the Dayton metro area ($205,000) offer affordable entry points for investors.

Lower purchase prices mean lower down payments and faster paths to positive cash flow—exactly what we want to see for our investors.

No Personal Income Verification

We know many real estate investors are self-employed, have fluctuating income, or prefer to keep their personal finances separate from their investment activities. Our DSCR loans eliminate the need for tax returns, pay stubs, or employment verification, making the approval process faster and more straightforward.

Digital Asset Recognition

Ohio’s investor community will appreciate that LendSure’s DSCR program accepts cryptocurrency holdings to satisfy reserve requirements.

Whether you’re holding Bitcoin, Ethereum, or other notable digital assets, you can demonstrate financial strength without liquidating your positions and triggering taxable events. This forward-thinking approach recognizes how modern investors actually manage their wealth.

Fallout Rescue: We Rescue Dead Deals

Ohio’s market moves fast. Sometimes deals collapse when lenders can’t deliver—underwriting issues, guideline problems, last-minute complications that shouldn’t kill a solid investment.

If another lender drops the ball on your Ohio investment property, we can often step in and save it. We accept transferred appraisals, use common sense in underwriting, and help you close in days instead of forcing you to start over.

In hot markets like Columbus and Cincinnati, that kind of reliability can be the difference between landing a great property and watching someone else take it.

Applying to LendSure’s DSCR Loan Program

We’ve designed our DSCR loan program specifically for real estate investors who need speed, flexibility, and commonsense underwriting.

Program Highlights

- Qualify on property cash flow only—no personal income verification required

- DSCR ratios as low as 1.0x

- Loan amounts up to $3,000,000 for 1-10 unit properties

- Close multiple loans simultaneously for the same investor

- Unlimited financed properties (up to 10 loans per investor)

- Non-warrantable condos and condotels allowed

- Purchase, rate-and-term refinance, and cash-out refinance options available

- Consideration of unique assets and cryptocurrency portfolios

This level of flexibility makes it possible for you to acquire properties quickly, scale your portfolio strategically, and keep your personal and business finances separate.

We make loans that make sense—loans that breathe, that bend, that see the person behind the paperwork.

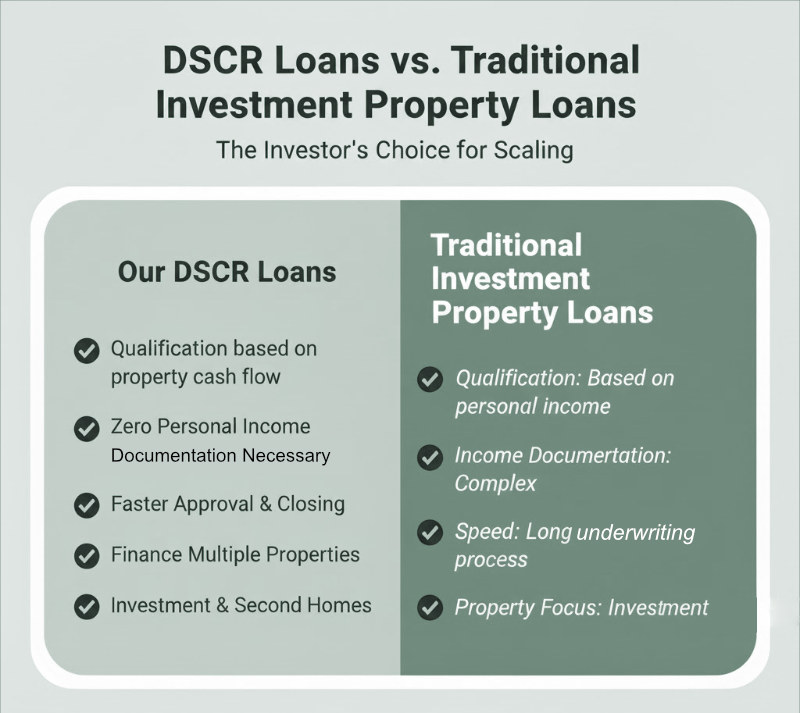

DSCR Loans vs. Traditional Investment Property Loans

Understanding the differences between our DSCR loans and traditional investment property financing can help you choose the right strategy.

Traditional Investment Property Loans:

- Qualification: Based on personal income

- Income Documentation: Tax returns, W-2s, pay stubs required

- Speed: Longer underwriting process

- Flexibility: Limited by DTI (debt-to-income ratio)

- Property Focus: Investment properties

Our DSCR Loans:

- Qualification: Based on property cash flow

- Traditional Income Documentation: None required

- Speed: Faster approval and closing

- Flexibility: Can finance multiple properties (up to 10 loans per investor)

- Property Focus: Investment and second homes only

For investors who want to scale quickly without personal income verification, our DSCR loans are the clear winner.

Why Investors Choose LendSure

Our approach to lending prioritizes practical solutions over rigid guidelines. While metrics like DSCR ratios and loan-to-value calculations matter, we recognize that each investor’s situation is unique. Our underwriting process accounts for context that traditional lenders often overlook.

This flexibility, combined with our specialized focus on investment property financing, allows us to approve loans that make economic sense—even when they fall outside conventional parameters.

If you’re looking to grow your rental portfolio in Ohio with DSCR financing that moves at the speed of opportunity, financing designed for active real estate investors with strategic growth plans, contact us today to discuss your investment goals.

Our team can walk you through specific scenarios, property examples, and show you how DSCR financing can accelerate your portfolio growth in Ohio’s rental markets.

Investors who want a closer look at current guidelines, leverage limits, and eligibility details can review LendSure’s Ohio DSCR loan program for a state-specific breakdown tailored to rental property financing.

Frequently Asked Questions

How do Ohio’s property taxes affect my investment returns?

Ohio’s average effective property tax rate is approximately 1.43%, though rates vary significantly by county. For example, Cuyahoga County (Cleveland) has an average rate of 2.18%, while Franklin County (Columbus) averages 1.64%.

Ohio assesses properties at 35% of market value, then applies the local millage rate to that assessed value. Recent legislation has tied property tax increases to inflation, potentially stabilizing costs for investors. When evaluating investment properties, factor in the specific county’s tax rate, as this directly impacts your DSCR calculation and overall cash flow.

Do I need to provide tax returns or W-2s for a DSCR loan?

No. One of the biggest advantages of our DSCR loan program is that we don’t require personal income documentation.

That means no tax returns, no W-2s, no pay stubs, and no employment verification. You qualify based solely on the property’s ability to generate rental income.

What’s the minimum DSCR ratio LendSure will accept?

Our standard DSCR ratios are as low as 1.0x, but we sometimes make exceptions if the loan makes sense. A ratio of 1.0 means the property’s rental income exactly covers the mortgage payment, taxes, insurance, and HOA fees. Ratios above 1.0 indicate positive cash flow, which strengthens your loan application.

How much can I borrow with a DSCR loan in Ohio?

LendSure offers loan amounts up to $3,000,000 for 1-10 unit properties. The actual loan amount depends on the property’s value, rental income, and your down payment.

Can I finance multiple properties at the same time?

Yes. LendSure allows you to close multiple DSCR loans simultaneously and finance unlimited properties, with up to 10 loans per investor. This makes it easy to scale your Ohio rental portfolio quickly across different markets like Columbus, Cleveland, Cincinnati, and Toledo.

Does LendSure accept cryptocurrency as reserves?

Yes. LendSure recognizes digital assets like Bitcoin and Ethereum to satisfy reserve requirements. You can demonstrate financial strength without liquidating your cryptocurrency holdings and triggering taxable events.

What if my deal with another lender falls through?

LendSure offers fallout rescue services for time-sensitive deals. If another lender fails to close your Ohio investment property loan, we can often step in to save the deal. We accept transferred appraisals and use commonsense underwriting to help you close in days rather than starting over from scratch.

What’s the approval process like?

Our DSCR loan process is streamlined for investors. Once you apply, we evaluate the property’s rental income and debt obligations to calculate the DSCR ratio. Because we don’t require personal income verification, the approval process is typically faster than traditional financing. Your Account Manager will guide you through every step.

Can self-employed borrowers use DSCR loans?

Absolutely. DSCR loans are ideal for self-employed investors, business owners, freelancers, and anyone who manages their tax strategy to minimize reported income. Since we don’t require tax returns or income verification, your on-paper income doesn’t matter—only the property’s cash flow.