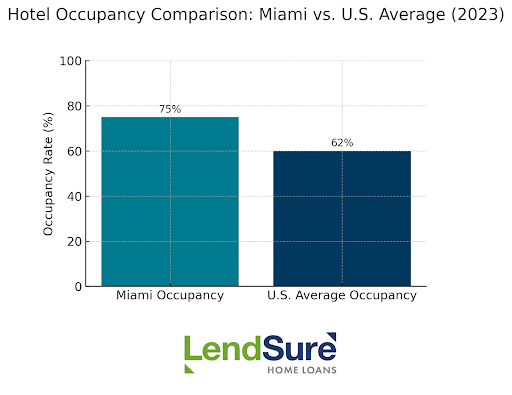

The condo hotel market in Miami offers something rare: a property you can enjoy personally that also generates rental income while you’re away. Miami’s tourism never stops, which means occupancy stays strong and revenue potential remains steady.

Miami’s hospitality economy is uniquely positioned to support this model, but due to lack of familiarity, most traditional lenders have difficulties approaching condotels because they do not understand the model.

Yet those who understand hospitality see the simplicity: a property that lives, earns, and breathes with the city it exists in. We specialize in condotel financing because we understand these properties as legitimate, professionally managed hospitality assets—capable of potentially producing stable income and long-term value.

The Condotel Model — And Why Miami’s Demand Drives Value

A condotel is a condo unit within a hotel that allows you to potentially generate rental revenue when you’re not occupying it. The hotel’s management company handles guest bookings, housekeeping, maintenance, and hospitality—providing turnkey cash-flow potential while also granting you a home for your vacations.

These are unlike timeshares in the sense that you actually own the property, not the time you spend on it.

The benefit: hands-off, potential revenue-producing ownership which allows for personal vacation use whenever you want it.

Financing Condotels

We specialize in condotel financing because we recognize what matters when it comes to condotel ownership:

- Does a professional operator manage the building?

- Does the building have a solid occupancy history?

- Can you afford payments if occupancy dips?

If yes to all three, we finance it.

Pre-qualification takes as little as a few hours. Once you have preliminary approval, underwriting typically moves quickly because condotel evaluation focuses on your assets, property, and building management, not your personal income complexity.

Flexible Qualification Options

Traditional income verification doesn’t always reflect a borrower’s true financial capacity, especially when dealing with investors, business owners, retirees, or those with diversified income sources. That’s why LendSure offers multiple paths to qualification:

- Full Documentation – Standard W-2s and tax returns for traditionally employed borrowers.

- Bank Statement Programs – Use 12–24 months of bank statements to document self-employed or non-traditional income.

- DSCR Qualification – Qualify based on the property’s projected rental income rather than personal income.

- Asset Depletion Qualification (Second Homes Only) – Ideal for borrowers with strong asset positions but limited reportable income.

Loan Terms

- Loan amounts up to $3,000,000 for quality condotels

- Up to 75% loan-to-value structure for purchases

- Up to 70% loan-to-value for rate & term refinances

- Up to 65% loan-to-value for cash-out refinances

You’ll need reserves, specifically liquid assets covering several months of payments—to show you can handle occupancy fluctuations.

Evaluating Miami Condotel Buildings

Not all condo hotel properties perform the same. Strong buildings share a few defining features:

Green Light Indicators

- Professional Hotel Management: Operated by an established hotel brand or proven hospitality group.

- Consistent Occupancy: Annual occupancy rates typically above 70%.

- True Residential Features: Units include full kitchens, not just standard hotel rooms. This is because cities like Miami differentiate between limited kitchen facilities” (microwave/small fridge only) and “full kitchen” units.

- Flexible Personal Use: No mandatory rental pooling or restrictions that limit when you can stay.

- High-Demand Location: The property draws both leisure and business travelers—South Beach, Brickell, Downtown, and waterfront districts tend to outperform.

Properties that meet these criteria generally provide stable rental income and maintain long-term capital appreciation potential.

Getting Started with Miami Condotel Financing

Start by identifying which Miami buildings interest you. Research the operator, occupancy history, and building quality.

Then gather your financial information: whatever documentation path works for your situation (employment letters, bank statements, or asset documentation).

The financing challenge has historically been finding a lender who understands these properties. At LendSure, our condotel program is built specifically for investors. We know the city, understand the buildings, and we recognize the income model. Most importantly we move quickly to get you funded.

Frequently Asked Questions

What makes a Miami condotel different from a regular condo investment?

A condotel is professionally managed like a hotel while you maintain individual ownership. You enjoy personal use rights and collect rental income when you’re not there. A regular condo requires you to manage the property yourself or hire a property manager and handle tenant relationships. Condotels eliminate that burden entirely.

Can I use a condotel loan to purchase a primary residence?

No. Condotel loans are designed for investment properties and second homes only. If you want to occupy the property as your primary residence, you’d need different financing. Condotel financing requires the property to be used for investment and personal use only.

What income documentation do I need for a Miami condotel loan?

It depends on your situation. W-2 employees provide tax returns and employment verification. Self-employed borrowers use bank statements. High-net-worth individuals with limited income use Asset Depletion for second homes. If the property has a rental history, the DSCR (investor cash flow) qualification works. LendSure offers flexibility to match your circumstances.

What happens if occupancy drops significantly?

Your mortgage payment stays the same regardless of occupancy. This is why reserves matter and why qualification evaluates your ability to cover payments in slower periods. Professional Miami hotel operators typically maintain consistent occupancy, but you need a financial cushion to handle potential downturns.

Can I refinance my Miami condotel later?

Yes. Rate-and-term refinances and cash-out refinances are available.

What are the biggest mistakes condotel investors make?

Buying in buildings with weak management companies or declining occupancy. Underestimating management fees and operational costs. Not verifying your personal use rights aren’t restricted. Not understanding the building’s specific rental pooling arrangements. Always evaluate the building, operator, and financials before committing capital.